YOU HEARD IT HERE

- PGCC

- Mar 20, 2024

- 3 min read

Our supply of oil is in trouble. In 2021 the International Energy Agency (IEA) called for an end to new investment in oil, gas and coal extraction. The IEA is a Paris-based intergovernmental organization established in 1974 (in the wake of the 1973 oil crises) to recommend international policies to stabilize energy supply. The USA is one of IEA’s 31 member nations.

But over its 50-year history the IEA’s concern transitioned from oil crises to climate change. In the name of achieving “net-zero” emissions by 2050, the IEA made the remarkable 2021 pronouncement that we should turn our backs on finding new fossil fuel supplies. Renewable energy companies cheered IEA’s call. And woke oil companies like Shell announced new pledges to cut carbon intensity and to direct development funds away from finding new oil reserves.

Acting in harmony with the IEA, huge investment firms like Blackrock (controlling ~ $10 trillion [yes, that’s Trillion] in assets) decline to invest in companies that develop fossil fuels. This is known as the ESG movement. See our recent blog on ESG, net zero, and how the Biden administration is using SEC rules to restrict investment in companies that are deemed to be “emissions intensive” How Net-Zero is Driving Up Food Costs (energy4life.today)

What is the result of this clamp-down on oil and gas investment? Ironically, the IEA just warned that, in 2024, the world is facing a “slight deficit” in oil supply. But it is the long-term prospects that should be our grave worry. An oil well’s best day is its first day; every day thereafter an oil well’s production declines. Around the world the average oil field decline is about 6% per year. World oil production (all liquids) is about 100 million barrels per day. That means we must find and produce about 6 million new barrels per day, every year, just to hold world oil production steady. However, (and despite all the rosy projections about “green” energy) world oil consumption grows every year, at the rate of at least 1 million barrels per day. Thus, we need to find and produce at least 7 million new barrels of oil per day, every year, to meet demand.

Under the stifling pressure of the ESG movement, massive new federal and state regulations, and with the panacea that we don’t need fossil fuels anymore, investment in new oil fields has collapsed over the last several years. OPEC is a sage observer of oil markets, and in 2023 OPEC warned loudly that underinvestment in the oil sector is “dangerous”. OPEC predicted that the world will require $12 trillion in new oil investments between now and 2045 in order to avoid oil price spikes. OPEC Warns of Dangerous Underinvestment in Oil

And now, in March 2024, none other than Shell comes along to echo OPEC’s warning. Citing underinvestment in oil and gas exploration Shell is warning the world is at risk of oil shortages. As it issued its warning Shell also announced cutbacks in its climate pledge to cut its own carbon intensity.

In its announcement, Shell admitted a fact that is on the home page of this blog: fossil fuels supply more than 80% of our energy. Is the world REALLY prepared for shortages in oil supply? It’s easy to call for an end to new oil development when you sit in the IEA office, or the oval office, when the room is a comfortable 72 degrees, and there’s a full buffet next door.

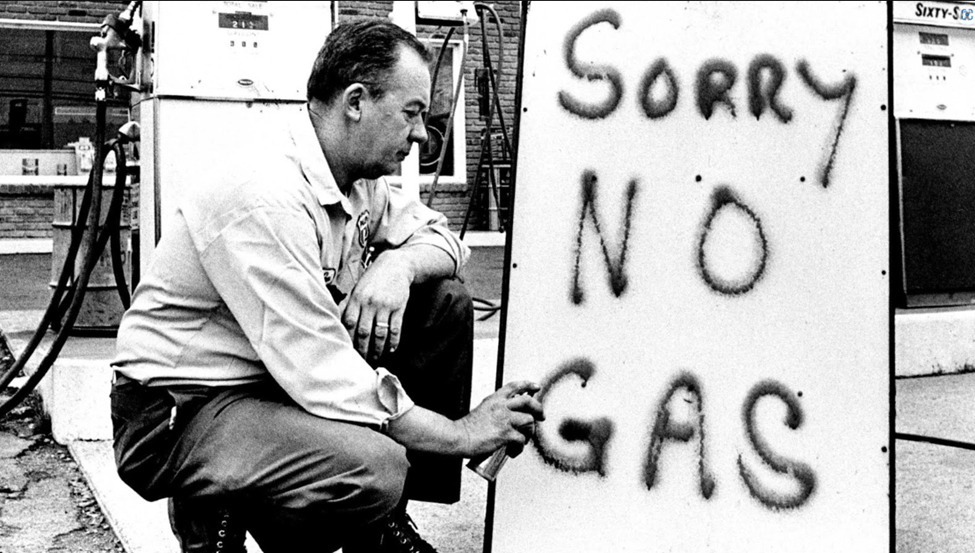

But the world looked a bit different in 1973.

If you’re too young to remember mile long gas station lines, you might want to read your history. 1973 oil crisis - Wikipedia

Comments